13 Financial Terms You Should Know

When FINRA Investor Education Foundation distributed a 5-question survey to test financial knowledge to over 25,000 adults, only 39% were able to answer at least four questions correctly. Every industry has terminology that can confuse those who don’t work with that vocabulary on a daily basis, and financial terms used by the financial industry is no exception.

Here are some common financial terms that are often confusing or misunderstood. Read through the list, and you’ll be able to bank with confidence!

13 commonly misunderstood financial terms

1. Annual Percentage Rate (APR): The yearly cost of borrowing money through a loan. The APR, or interest, represents the percentage of the loan principal that you’re expected to pay back in addition to the loan amount.

2. Annual Percentage Yield (APY): The interest that you will earn back yearly on a savings or investment account.

3. Automated Clearing House (ACH): A nationwide network that handles participating financial institutions’ transactions. You may see ACH in front of transaction details on your account statement, meaning they handled the transfer.

4. EMV or Chip Technology: Every time you use a chip-enabled card at a terminal, the embedded chip generates a unique transaction code to prevent stolen data.

5. Direct Deposit: A service commonly used by employers to deposit regular monthly payments directly into your chosen account, rather than receiving a check.

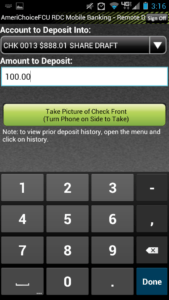

6. Mobile Check Deposit: A free service on your mobile banking app. You are able to deposit a check into your account, anywhere in the world, simply by taking a picture.

7. Overdraft: An overdraft occurs when your financial institution makes a scheduled payment or fulfills a check on your behalf, even though there are not enough funds in your account. There are often fees involved with overdrawing your account, and also protection services that will use funds from a different account if an overdraft is going to occur.

8. Personal Identification Number (PIN): A set, confidential code through which you access your account at an ATM or during a debit card transaction.

9. Principal: The amount of money that is borrowed through a loan, or the amount of money that is still owed back through a loan not including interest. In a $100,000 loan, $100,000 is the principal. If you pay back $50,000, the remaining $50,000 owed is still called the principal.

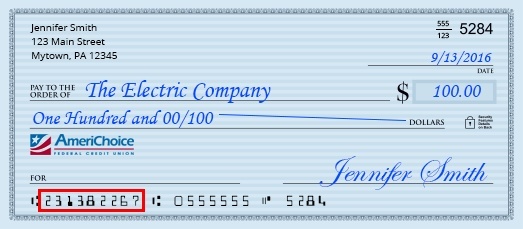

10. Routing Transit Number (RTN): A 9-digit number that identifies a specific financial institution during a transaction. You can find your account’s routing number at the bottom of your checks.

11. Share Account: This is a term specific to credit unions. A share account is a standard savings account, but it also represents your stake, or share, in the credit union as a member.

12. Stop Payment: A member may request that a check or payment not be fulfilled or paid out. This is usually requested when a purchase is being disputed, or a check is lost or stolen. Normally, one must pay a fee for this service.

13. Variable Rate: This interest rate on a loan will adjust up or down after the initial loan period determined by the financial institution. After that initial period, it will continually fluctuate in intervals set by the financial institution, whether that be monthly, yearly, etc.

By learning these 13 commonly misunderstood financial terms, you have helped to overcome the lack of financial education in the country, and will now be able to navigate your bank accounts with more confidence.

Have other terms you want explained? Please comment below and we will be sure to provide you with more information. Subscribe today to learn more about financial terms and stay up to date with valuble tips and ways to save your money!

-2.png?width=300&height=65&name=AFCU-logo-2019-white-sm%20(1)-2.png)