The Beginner’s Guide to Starting Your Emergency Savings Fund

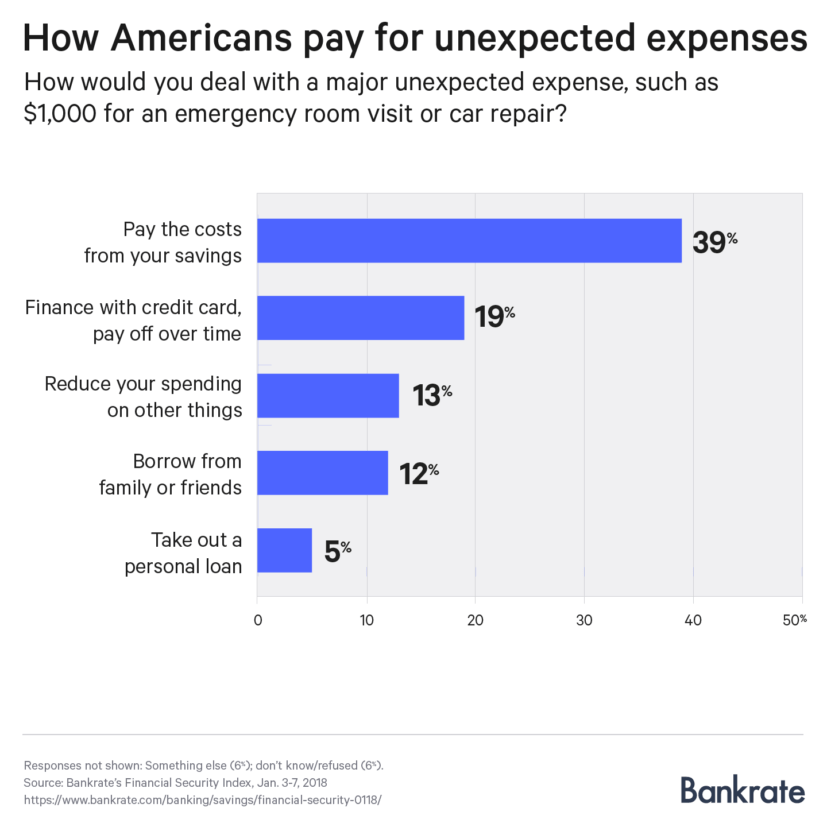

In the Federal Reserve’s 2017 survey, 44% of respondents would not be able to cover a $400 unexpected expense with their savings. More recently, this Bankrate survey showed that less than half of Americans could cover a $1,000 expense with an emergency savings fund.

An emergency fund is vital to financial security. How would you pay for a $400 or $1,000 emergency expense right now? If your answer isn’t to cover it with the money in your emergency savings fund – keep reading.

What is an emergency savings fund?

An emergency fund is money that provides a buffer between financial stability and financial ruin. This fund can cover unexpected expenses so that the cost doesn’t affect your regular financial commitments. Examples of emergency expenses include:

- Car repairs

- House repairs

- Medical visits

- Job loss

- And much more

The fund covers expenses that aren’t in your normal, monthly budget. An emergency fund can give you the financial stability to take risks and live the life you want to live. If you find that money is dictating every decision you make in your life, or you live in fear that an unexpected cost will arise that you can’t afford – then an emergency fund can transform your life.

If you don’t already have an emergency fund squirreled away, make it a priority now!

How much should you have saved in your emergency fund?

The general rule is to save between three to six months of total living expenses in your emergency fund. Since every individual will have varying living expenses, you’ll need to calculate your own savings goal by creating a budget.

Use our budget template to create your monthly budget.

A budget will break down all of your monthly income and expenses. Once you know how much money you spend each month, multiply that number between three and six to come up with the amount you should keep in your emergency fund.

For example, if your monthly expenses are $3,500. You should try to save between $10,500 and $21,000 in your emergency savings fund.

How long will it take to save up an emergency fund?

It could take only six months, or it could take 1-2 years for you to save up 3-6 months of living expenses. You may be able to devote the majority of your budget to saving up money, or you may be living on a tight budget and can only put away a small amount each month.

No matter how long it takes you, every dollar counts. Don’t let the idea of what you should be saving get in the way of saving anything at all. If you’re only able to put away $50 a month – that’s still $50 you didn’t have saved previously. In a year – you’ll have $600 available in case of emergency!

5 tips for building your emergency savings

1) Keep the emergency fund in a separate account from your checking account.

You probably use your checking account and debit card on a daily basis. You don’t want to be able to use your emergency fund on a whim. Keep the savings in a separate account so that you aren’t tempted to spend them. If you want to make it more difficult to access the funds, keep them at a different financial institution than your checking account.

We recommend using a basic savings account at a financial institution to store your emergency fund. They provide access to the fund within a day’s notice but aren’t attached to an easy spending tool like a debit card.

2) Set realistic savings goals.

Start small and increase the goals as you gain confidence. Set daily, weekly, or monthly goals you know you can achieve.

3) Treat the savings as a mandatory expense.

You can mentally trick yourself into making the emergency fund a priority. Treat the savings like a required expense in your monthly budget.

Get more psychological savings tricks here – like competing against family members or building in rewards when you meet specific savings goals!

4) Pay yourself first.

Most employers can divert a portion of your paycheck into a different account than your usual checking account. Ask them to direct deposit your savings goal directly into your emergency fund each time you’re paid. Saving becomes easier when you don’t have to think about it!

5) Find a way to increase your monthly income.

If your current budget is tight, find a way to increase your income and put that extra money directly into your emergency fund. Whether it’s your tax return, a cash present for your birthday, or a concerted effort at earning more money – save that extra money before it ever touches your checking account.

Find out 23 ideas to make more money and stop living paycheck-to-paycheck.

Start saving up an emergency fund today – and come back and let us know in the comments how you made it happen within your budget!

-2.png?width=300&height=65&name=AFCU-logo-2019-white-sm%20(1)-2.png)