Breaking Down 7 Different Types of Credit Cards

When a google search for the best credit cards yields millions of results – it can be difficult to answer the question ‘what credit card should I get?’ There’s many types of credit cards and different types work best for different people and different situations. We’ve broken down seven types of cards so that you can find the credit card that’s right for you.

1. Rewards Credit Card

These credit cards offer rewards each time you spend money. Rewards can come in the form of travel benefits, cash back, or points you can redeem. Frequent travelers can fly for free if they earn enough airline miles. Some cards give higher cash back percentages for shopping at specific places – like gas stations and grocery stores.

While these cards can give you benefits you wouldn’t have earned by simply paying in cash, they carry the same downsides as any credit card. If you aren’t able to pay off your balance each month, you’ll rack up interest before you know it. Plus, many rewards cards also come with annual fees in addition to monthly interest.

Best for: A responsible credit card user who wants to leverage their spending for extra benefits.

Apply for AmeriChoice’s VISA Platinum Preferred card, which gives you bonus points for every dollar you spend to use on merchandise, travel and more.

2. Low-interest Credit Card

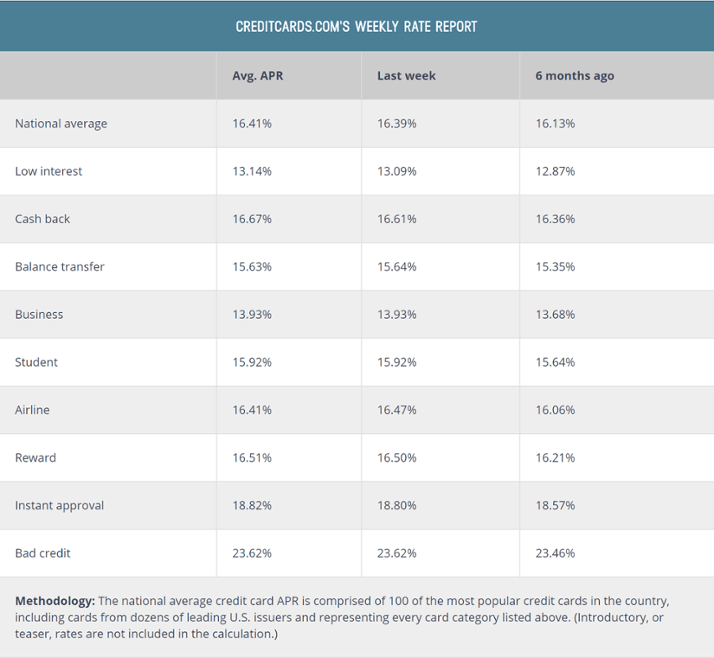

With the average credit card interest rate sitting at 16.41%, finding a low-interest card can be a challenge. Your best bet is probably your local credit union. Our VISA Platinum card starts at only 8.90% – a good deal below the national average. It’s more common for smaller, local financial institutions to offer better rates on their credit cards.

Keep in mind that if your card has a low-interest rate, it probably won’t come with any special benefits. These types of cards are great for people who worry that they may carry a balance some months, or only plan on using the card as back-up in emergency situations.

Best for: Users who only plan on using the card as back-up or want to reduce the risk of high-interest payments.

3. Balance Transfer Credit Card

Some credit cards encourage you to transfer your current credit card balance to their credit card. These transfers are incentivized with 0% interest rate offers within certain promotional periods.

We recommend using a balance transfer card if you can qualify for a drastically lower interest-rate and the new card won’t charge a fee for the transfer. Also, make sure you can pay off the entire balance before the promotional rate ends and jumps back up to a higher interest rate.

Best for: Someone who wants to pay less in interest while working to pay off their credit card balance.

Find out if a credit card balance transfer would save you money.

4. Secured Credit Card

Most credit cards on the market are unsecured credit cards. This means that the lender gives you access to an approved credit limit and trusts that you can pay that back. Secured credit cards operate on prepaid deposits. The amount you can put down up-front will determine the credit limit you have access to. Lenders can be secure in the knowledge that even if you fail to pay off your credit limit of $300, they have your initial $300 deposit to cover the loss.

Sometimes young adults who don’t have enough credit history yet, or someone who has a poor credit score, will qualify for a secured credit card but not an unsecured card. These cards are great tools to work on building up your credit until you can qualify for unsecured cards.

Best for: Someone who has bad credit or no credit history but can provide proof of income.

5. Retailer Credit Card

Stores understand that offering credit cards can be an easy way for them to make a profit. That’s why so many cashiers encourage you to sign up. These cards are offered in partnership with retailers, like Amazon or Macys, to offer benefits and discounts to those who use the card at that retailer. But they are also known for outrageous interest rates.

We only recommend experienced, responsible users sign up for these cards. Remember that if you leave a balance on the card every month, what you may save in store discounts is less than you may end up paying in interest.

Best for: Responsible credit card users who frequent the retailer the card is issued from.

Check out all of the pros and cons to store credit cards here.

6. Student Credit Card

If you’re just starting out, some lenders offer credit cards specifically to college students. It’s easier to qualify for this unsecured card but be prepared for high-interest rates and low credit limits. We recommend users pay off their balance in full every month. Regardless of the cons, getting your first credit card is a great way to improve you credit score and get better offers in the future.

Best for: A student in college who wants to start building up their credit history.

7. Business Credit Card

Business owners deal with a ton of expenses on a daily basis. Business credit cards come with rewards for all of that spending. Users can easily track their business expenses separate from personal expenses. Many business cards require excellent credit and/or an annual fee.

Best for: Business owners who want to separate their business expenses from their personal expenses.

Responsible Usage is Key

Credit cards can be a great tool, no matter the type you decide on, but only if you use them responsibly. Learn how to use a credit card to improve your credit score here. Real advice that really works! Read the article now.

-2.png?width=300&height=65&name=AFCU-logo-2019-white-sm%20(1)-2.png)