What is Identity Theft Protection?

What can I do to protect myself from identity theft? We get this question from our members all the time. It’s no wonder with identity theft ranking in no. 2 out of all the consumer fraud reports in the U.S. There a many simple ways you can protect your personal information, including using identity theft protection.

What is Identity Theft Protection?

If a criminal uses your personal information to make a purchase in your name – that’s identity theft. They could use information like your social security number or credit card number to open bank accounts, rent apartments, or even hijack your tax refund.

Identity theft protection is a service that defends you from identity theft criminals. The service could include credit monitoring, fraud alerts, and recovery assistance if someone has stolen your identity.

Credit monitoring – the service will actively monitor your credit reports and notify you of any changes to your credit

Fraud alerts – the service will notify you if it suspects fraud, like a bank account opened in your name in a different state

Recovery assistance – the service will help you recover your stolen identity and any money you lost as a result of the crime

Comparing Identity Theft Programs

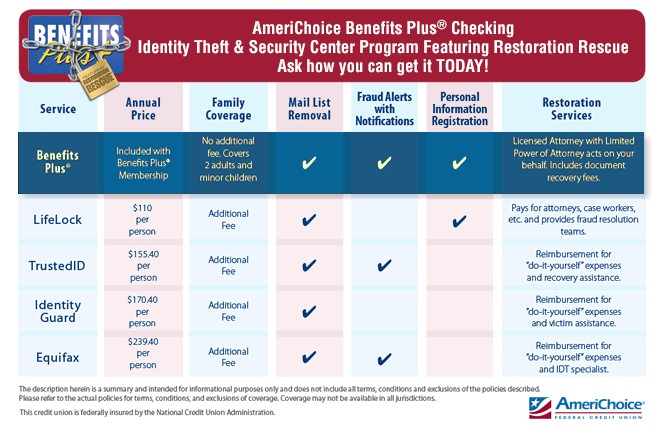

Not all identity theft protection is created equal. They differ in price, the types of services included in that price, and the quality of the protection. Make sure you research the program before signing up!

See how AmeriChoice’s identity theft program compares to some other popular services.

Tip from the Experts:NerdWallet also has a great comparison between LifeLock, IdentityForce, and ID WatchDog. They recommend seeking out identity theft programs if you have already been a victim of identity theft, you don’t want to freeze and unfreeze your credit report, or you would prefer to let someone else actively monitor your credit.

If you don’t have existing protection and are worried that you’ve been a victim of fraud, you can place a security freeze and fraud alert on your credit report for free. The freeze will prevent any new accounts being opened in your name. The fraud alert will notify lenders to take additional precautions before opening an account in your name.

How to Protect Your Identity Before It’s Stolen

The best protection program is to safeguard your personal information before it’s stolen! It’s free to take these preventative steps.

1) Memorize your social security number so you don’t have to carry your SSN card with you.

2) Create a password for your phone and increase the complexity of the passwords you already use.

3) Place a hold on your mail if you won’t be home for a few days.

Read 4 more foolproof identity protection tips here.

How do you protect your identity on a daily basis? Leave us a comment to share your personal tips!

Sign Up for Benefits Plus with AmeriChoice!

Our exclusive member program includes an identity theft program called Restoration Rescue. If your identity is ever stolen, a team of licensed attorneys will help you recover your identity. The coverage extends to your immediate family as well. Find out more about Restoration Rescue and ask a Member Service Representative to sign you up today!

-2.png?width=300&height=65&name=AFCU-logo-2019-white-sm%20(1)-2.png)